Your Money.Finally MakesSense.

Finanjo brings together everything about your money - spending, saving, budgeting, and beyond in one smart ecosystem.

Unlock the Power of Finanjo

Experience smart financial management with AI-powered insights, automated tracking, and personalized recommendations to help you take control of your money.

Track, Organize & Group

See everything. Automatically.

- Live transaction sync from all linked accounts

- Smart categorization by merchant and type

- Custom grouping for trips, bills, subscriptions, etc.

- Real-time cash flow visibility

Reminders, Budgets & Control

Stay on top of every commitment.

- Auto-detect recurring payments & EMIs

- Smart, adaptive budgets powered by AI

- Split bills directly from transactions

- Renewal and payment reminders

Finanjo AI Assistant

Your personal finance brain.

- Personalized money insights & nudges

- Predictive alerts for upcoming expenses

- Q&A-style assistance for quick answers

- Actionable recommendations to save more

Invest, Grow & Build Wealth

Turn clarity into confidence.

- Credit score & EMI tracker

- Unified investment dashboard for SIPs, stocks & funds

- Insurance renewals & policy management

- AI-driven investment suggestions (coming soon)

What's Live

Start managing money smarter - right now.

See your money move - and make it work smarter.

Finanjo gives you real-time visibility into your spending power and cash flow. Instantly know how much you can safely spend after rent, EMIs, and subscriptions - while every inflow and outflow is automatically tracked, categorised, and analysed.

See where your money really goes.

Finanjo automatically categorizes every expense - from groceries to subscriptions — giving you a clear picture of your spending habits and patterns.

All your accounts. One clean feed.

Finanjo merges all your bank, UPI, and card transactions into one place - instantly organized and searchable.

Turn chaos into clarity.

Group or filter your spends by category, mood, or event. Track Weekend Trips, Bills, or Subscriptions - without ever typing a thing.

Split expenses directly from your transactions.

Whenever you pay for something shared - like rent, dinner, or groceries - Finanjo detects it automatically. You can split that expense right from your transaction feed, assign people, and send reminders instantly - without typing amounts or creating a new record.

What's Next

Building the future of personal finance.

Subscriptions Manager

Stay in control of recurring expenses.

Finanjo automatically tracks your OTT, app, and bill subscriptions so you know exactly what renews when.

Detects recurring charges automatically

Renewal reminders

Monthly summary of total spend

Smart Budgets

Budgets that understand you.

Finanjo's AI will soon create adaptive budgets based on your real spending. No fixed limits - just intelligent guidance that evolves with you.

AI-powered dynamic budgeting

Real-time spend insights

Overspend notifications

Set Your Goals

Invest and grow daily towards what truly matters.

Set personal financial goals — from a new bike or phone to your dream home — and let Finanjo guide your savings with smart, AI-powered insights. Invest and grow daily towards what truly matters.

AI-guided saving strategy

Flexible EMI or full-payment options

Start SIPs linked to your goals

Finanjo AI Assistant

Your personal finance coach.

The Finanjo AI Assistant will help you plan, predict, and protect your money. Ask questions, get insights, and take action - instantly.

Personalized financial insights

Predictive alerts and reminders

24×7 chat-based finance guidance

Refer & Earn Together

Share Finanjo with friends and both of you get rewarded. It's a win-win!

Share Your Referral Code

Invite friends to Finanjo using your unique referral code.

Friend Joins & Uses Finanjo

Your friend signs up, completes account setup, and makes their first successful split or saving.

Both Get Rewarded

You and your friend earn rewards — up to ₹100 per referral, credited after successful verification.

Safe, Private & Regulated.

Your financial data deserves the highest level of protection. That's why we've built Finanjo with enterprise-grade security and regulatory compliance at its core.

Control in Your Hands

From access to usage, every part of your data journey stays in your control.

Safety at the Core

Bank-grade 256-bit SSL encryption ensures your data is always secure.

Built on Trust

Powered by the RBI-licensed Account Aggregator framework, your data is never stored, sold, or shared.

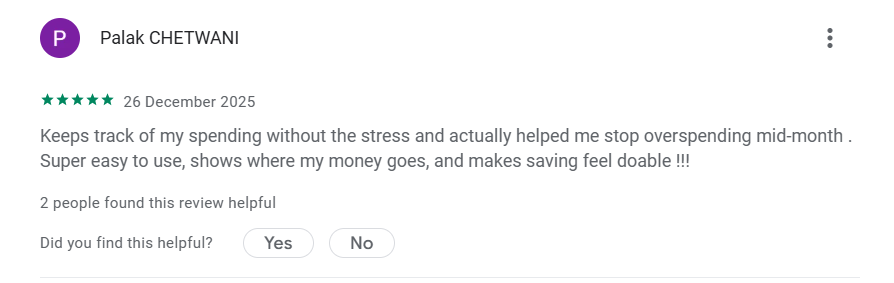

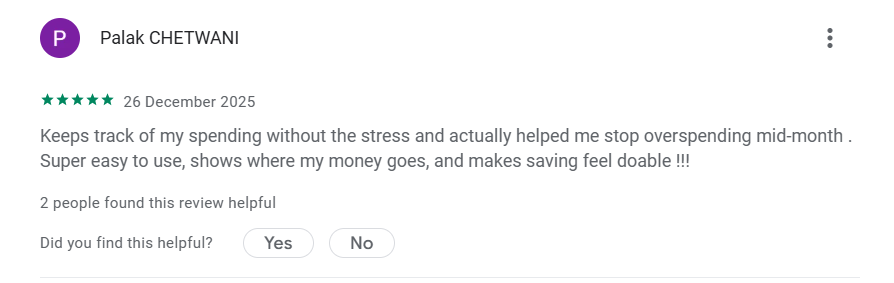

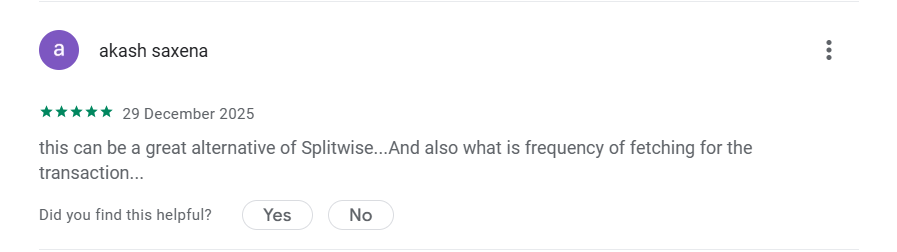

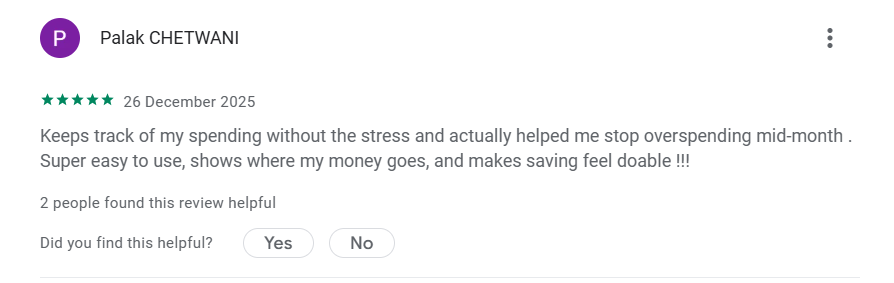

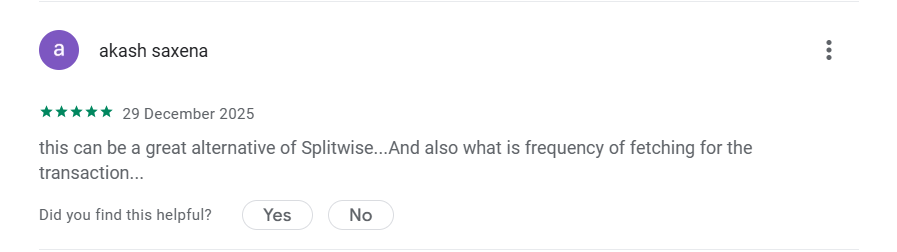

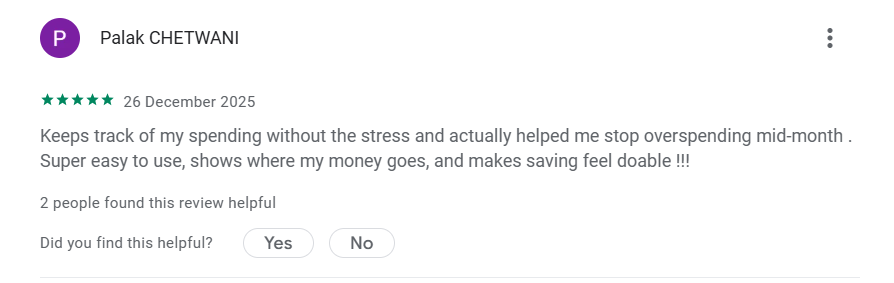

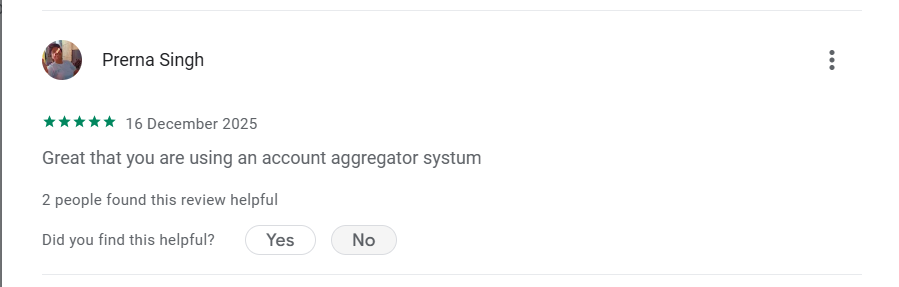

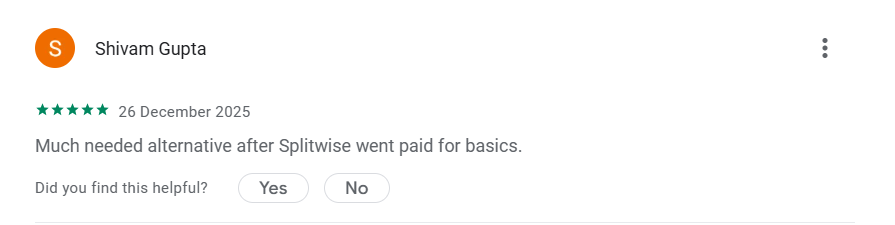

Loved by Users

See what our community is saying about their experience

Frequently Asked Questions

Everything you need to know about Finanjo. Can't find what you're looking for? Contact our support team.