SBI General Home Insurance provides is a comprehensive offering that protects your home and its contents against unexpected and unfortunate events. It typically covers losses arising from natural disasters like fire, earthquake, floods, and storms, as well as man-made incidents such as theft, or burglary. Home insurance, depending on your chosen plan, can safeguard not only your house’s structure but also its contents, such as furniture, appliances, and other valuable possessions. This article explains the complete process to claim SBI General Home Insurance.

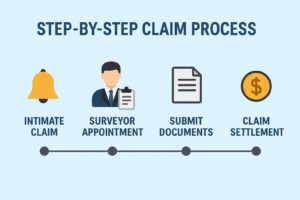

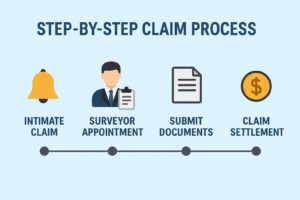

To start the claim process, you should notify SBI General immediately after the incident-

To notify call the SBI General customer care number at 1800 102 1111, and once you provide essential details like policy number, date and time of the incident, and a brief description of the damage or loss a surveyor will be appointed to estimate the loss or damage, based on the type of loss viz. fire / burglary etc.

You can notify SBI general by emailing them at [email protected]

Visit the “Claim Intimation” section on the SBI General Insurance website and fill out the form (https://www.sbigeneral.in/claim ).

Once you provide essential details like policy number, date and time of the incident and a brief description of the damage or loss and then a surveyor will be appointed in 48 hrs to estimate the loss or damage, based on the type of loss via fire / burglary etc.

Fill the claim form and submit following documents–

Claim Form (duly filled)

Policy document

Police FIR (for burglary claims) and police investigation report

Fire brigade report (if applicable)

Proof of house ownership or rent agreement (for tenants)

Policyholder contact details

The surveyor evaluates the extent of the damage and submits a report to SBI General. The insurer then assesses the claim based on the policy coverage and documents provided.

After assessment, SBI General shares an offer of settlement with you. If you agree to the proposed claim amount, you need to give your consent to proceed further.

After you give consent, the approved claim amount is released directly to your registered bank account, completing the claim process.

It’s basically a safety net for your house. If something unexpected happens—like fire, floods, or theft—this policy helps you handle the money part instead of stressing alone.

It can protect your home structure and also the things inside your house, like furniture, electronics, and valuables. You choose what you want covered.

Yes. Situations like earthquakes, floods, storms, or cyclones are covered, as long as they’re mentioned in your policy.

Damage due to fire, lightning, or explosions is covered, so you don’t have to bear the full repair cost yourself.

Yes. If someone breaks in and steals your belongings, the policy helps cover that loss.

Yes. Even tenants can insure their household items and valuables, even if the house itself isn’t owned by them.

Not necessarily. You can insure just the building, just the contents, or both—whatever makes sense for you.

It depends on things like the value of your home, what you choose to insure, and where your house is located.

First, make sure everyone is safe. Then inform SBI General Insurance, take photos of the damage, and keep any related bills or proofs.

You can do it online, through customer care, or with help from your agent. The process is straightforward if documents are ready.

Your policy details, a filled claim form, photos or videos of damage, bills if available, and an FIR in case of theft.

Once everything is submitted properly and verified, claims are usually settled without unnecessary delays.

Yes. Normal wear and tear, intentional damage, or losses not mentioned in the policy are usually excluded.

Yes. You can renew it online before it expires so your home stays protected without a break.

Because it gives peace of mind. When something goes wrong, you don’t have to worry about sudden expenses on your own.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.

Be the first to share your thoughts!

SBI General Home Insurance provides is a comprehensive offering that protects your home and its contents against unexpected and unfortunate events. It typically covers losses arising from natural disasters like fire, earthquake, floods, and storms, as well as man-made incidents such as theft, or burglary. Home insurance, depending on your chosen plan, can safeguard not only your house’s structure but also its contents, such as furniture, appliances, and other valuable possessions. This article explains the complete process to claim SBI General Home Insurance.

To start the claim process, you should notify SBI General immediately after the incident-

To notify call the SBI General customer care number at 1800 102 1111, and once you provide essential details like policy number, date and time of the incident, and a brief description of the damage or loss a surveyor will be appointed to estimate the loss or damage, based on the type of loss viz. fire / burglary etc.

You can notify SBI general by emailing them at [email protected]

Visit the “Claim Intimation” section on the SBI General Insurance website and fill out the form (https://www.sbigeneral.in/claim ).

Once you provide essential details like policy number, date and time of the incident and a brief description of the damage or loss and then a surveyor will be appointed in 48 hrs to estimate the loss or damage, based on the type of loss via fire / burglary etc.

Fill the claim form and submit following documents–

Claim Form (duly filled)

Policy document

Police FIR (for burglary claims) and police investigation report

Fire brigade report (if applicable)

Proof of house ownership or rent agreement (for tenants)

Policyholder contact details

The surveyor evaluates the extent of the damage and submits a report to SBI General. The insurer then assesses the claim based on the policy coverage and documents provided.

After assessment, SBI General shares an offer of settlement with you. If you agree to the proposed claim amount, you need to give your consent to proceed further.

After you give consent, the approved claim amount is released directly to your registered bank account, completing the claim process.

It’s basically a safety net for your house. If something unexpected happens—like fire, floods, or theft—this policy helps you handle the money part instead of stressing alone.

It can protect your home structure and also the things inside your house, like furniture, electronics, and valuables. You choose what you want covered.

Yes. Situations like earthquakes, floods, storms, or cyclones are covered, as long as they’re mentioned in your policy.

Damage due to fire, lightning, or explosions is covered, so you don’t have to bear the full repair cost yourself.

Yes. If someone breaks in and steals your belongings, the policy helps cover that loss.

Yes. Even tenants can insure their household items and valuables, even if the house itself isn’t owned by them.

Not necessarily. You can insure just the building, just the contents, or both—whatever makes sense for you.

It depends on things like the value of your home, what you choose to insure, and where your house is located.

First, make sure everyone is safe. Then inform SBI General Insurance, take photos of the damage, and keep any related bills or proofs.

You can do it online, through customer care, or with help from your agent. The process is straightforward if documents are ready.

Your policy details, a filled claim form, photos or videos of damage, bills if available, and an FIR in case of theft.

Once everything is submitted properly and verified, claims are usually settled without unnecessary delays.

Yes. Normal wear and tear, intentional damage, or losses not mentioned in the policy are usually excluded.

Yes. You can renew it online before it expires so your home stays protected without a break.

Because it gives peace of mind. When something goes wrong, you don’t have to worry about sudden expenses on your own.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.

Be the first to share your thoughts!